ADA Price Prediction: Navigating Current Volatility for Long-Term Growth

#ADA

- Technical Positioning: ADA trades below moving average but shows positive MACD momentum, suggesting potential reversal patterns

- Market Sentiment: Negative headlines and whale diversification create near-term headwinds, but may present contrarian opportunities

- Risk-Reward Profile: Current levels offer favorable entry for long-term investors despite short-term volatility concerns

ADA Price Prediction

Technical Analysis: ADA Shows Mixed Signals Amid Consolidation

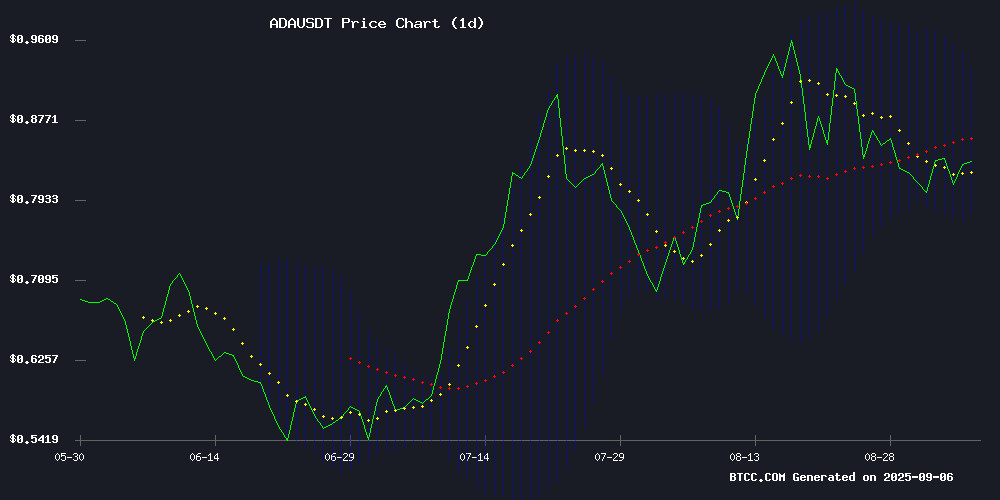

According to BTCC financial analyst Michael, ADA's current price of $0.8245 sits below its 20-day moving average of $0.85335, indicating near-term bearish pressure. However, the MACD reading of 0.048015 versus its signal line at 0.022082 shows positive momentum with a histogram of 0.025933. The Bollinger Bands position suggests ADA is trading in the lower range of its recent volatility band, potentially signaling an oversold condition that could present buying opportunities for patient investors.

Market Sentiment: Negative Headlines Weigh on ADA Outlook

BTCC financial analyst Michael notes that recent news flow surrounding Cardano has turned predominantly negative, with headlines predicting price crashes and highlighting whale diversification into alternatives like Remittix. The struggle to break above $0.88, combined with competitive pressure from emerging altcoins, creates near-term headwinds. However, Michael suggests that negative sentiment often creates contrarian opportunities when technical indicators show potential reversal signals.

Factors Influencing ADA's Price

Cardano Price Expected To Crash In 2026 As Whales Pivot To Remittix

Cardano's price trajectory is faltering, with analysts predicting a significant downturn by 2026. Once a bastion of resilience, ADA is now seeing large-scale sell-offs by whales, signaling a loss of confidence in its near-term prospects.

Investors are reallocating capital to emerging projects like Remittix, a PayFi platform bridging crypto and traditional banking. Its real-world utility and high ROI potential for 2025 are drawing attention away from stagnant layer-1 chains.

On-chain data reveals sustained distribution by major ADA holders, compounded by competitive pressure from Ethereum L2s and cross-chain DeFi alternatives. The looming 2026 correction window is accelerating this capital rotation.

XYZVerse vs. Cardano: Analysts Weigh In on Optimal Entry-Level Crypto Investment

Market newcomers face a conundrum when selecting between XYZVerse and Cardano (ADA) for their first crypto investment. While both tokens present compelling cases, Cardano's recent price action offers a clearer narrative for risk-adjusted positioning.

ADA currently trades in a tight $0.77-$0.89 range, reflecting a 3.61% weekly decline but maintaining 14.07% monthly gains. The convergence of its 10-day and 100-day moving averages at $0.82 signals consolidation, with technical indicators suggesting potential upside. A breakout above $0.97 could catalyze a 12% rally toward the psychologically important $1 level.

Market structure appears favorable, with RSI at 58.72 maintaining bullish momentum despite short-term overbought conditions. Critical support lies at $0.73, representing a 15% downside risk from current levels, while a breach of $1 could open path to $1.10.

Cardano Struggles Below $0.88 as PayFi Altcoin Gains Attention

Cardano's price remains trapped below $0.88, with ADA oscillating between $0.80 support and $0.85 resistance. Analysts suggest a breakout above $0.88 could signal a rally toward $1.20, but short-term indicators show overbought conditions.

Meanwhile, Remittix, a PayFi altcoin, is drawing interest for its utility-driven approach. Unlike Cardano's stagnation, Remittix offers fast cross-border transfers and real-time FX solutions, positioning itself as a tangible alternative to speculative assets.

Is ADA a good investment?

Based on current technical and fundamental analysis, ADA presents a mixed investment case. The cryptocurrency currently trades below key moving averages but shows positive MACD momentum. From a risk-reward perspective, the Bollinger Band positioning suggests potential upside if support holds.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $0.8245 | Below MA |

| 20-day MA | $0.85335 | Resistance |

| MACD | 0.048015 | Bullish |

| Bollinger Position | Lower Range | Oversold |

While negative news sentiment creates near-term pressure, the technical setup suggests potential for recovery toward the middle Bollinger Band around $0.853. Investors should consider dollar-cost averaging and maintain a long-term perspective given Cardano's established ecosystem.